Home Improvement Deduction 2025

Home Improvement Deduction 2025. Beginning january 1, 2025, the credit becomes equal to the lesser of 30% of the sum. How to claim home improvement tax benefits.

Business Use Of Home Deduction 2025 Fayre Jenilee, The ira includes multiple clean energy tax credits to help you do.

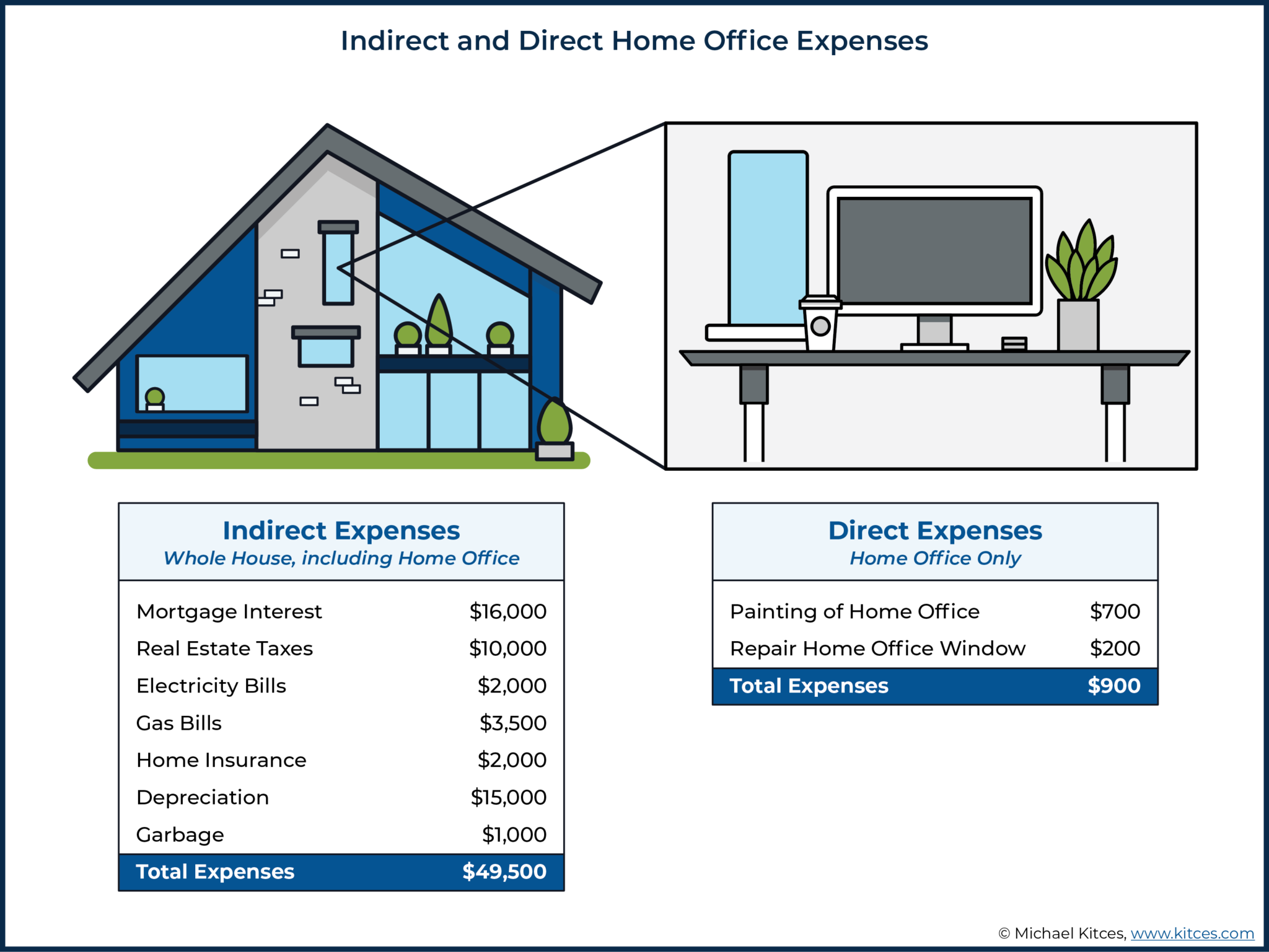

Self Employed Home Office Deduction 2025 Debra Eugenie, The standard deduction amounts will increase to $15,000 for individuals and married couples filing separately, representing an increase of $400.

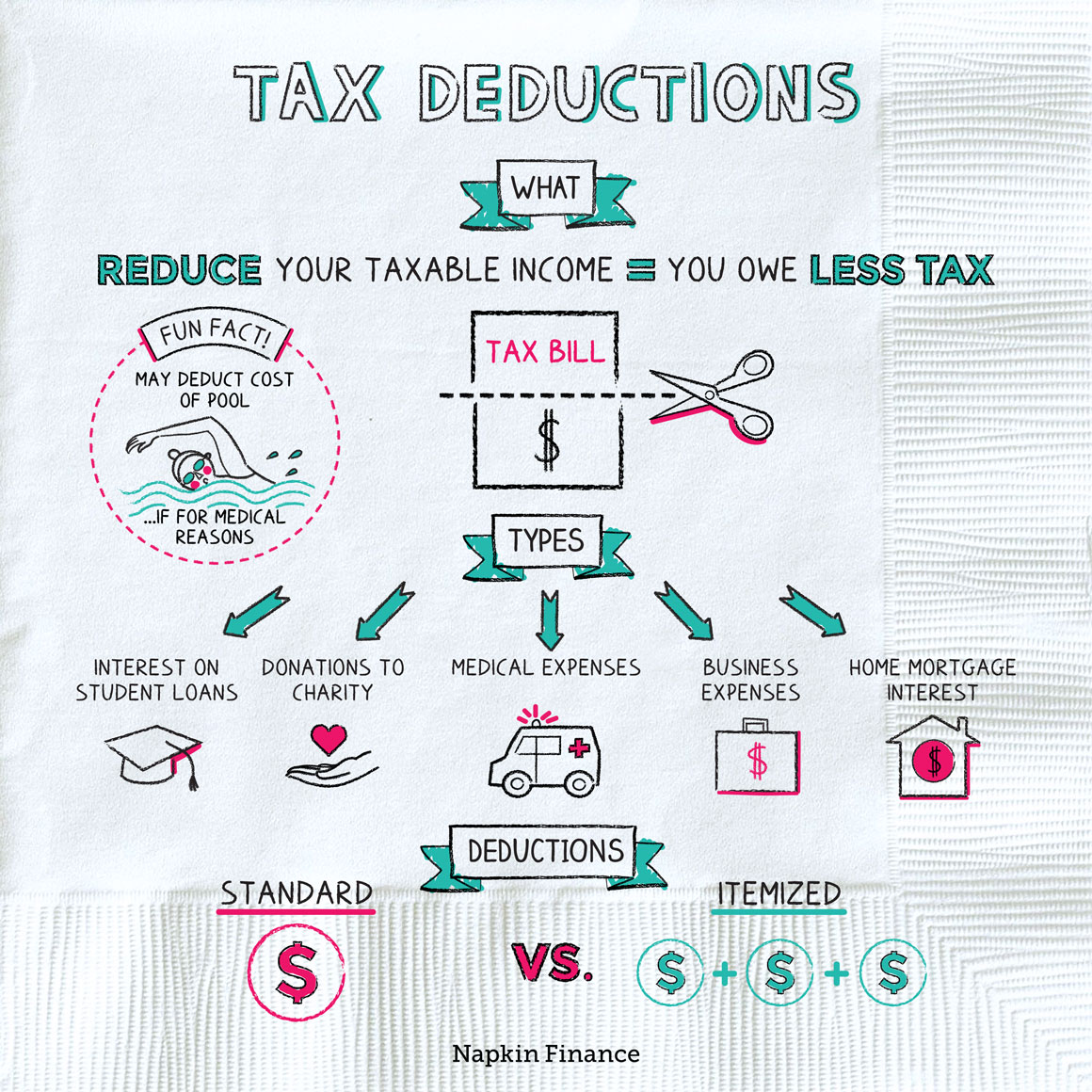

Tax Deductible Home Improvements Tax deductions, Home improvement, An addition or improvement, such as renovating a house, is a major capital improvement if its original cost is both:

SelfEmployed Home Improvement Deductions, The mhrtc could provide a valuable refundable credit for.

![7 Home Improvement Tax Deductions [INFOGRAPHIC]](https://help.taxreliefcenter.org/wp-content/uploads/2018/07/Tax-Relief-Center-7-Home-Improvement-Tax-Deductions-For-Your-House-FEATURED.jpg)

Energyefficient home improvements that can help lower taxes in 2025, The energy efficient home improvement credit can help homeowners cover costs related to qualifying improvements made from 2025 to 2032.

Self Employed Home Office Deduction 2025 Debra Eugenie, The energy efficient home improvement credit can help homeowners cover costs related to qualifying improvements made from 2025 to 2032.

7 Home Improvement Tax Deductions [INFOGRAPHIC] Tax deductions, If a depreciating asset is used in gaining your assessable income, generally.

a house with the words 7 home improvement tax deductions for your house, You can claim a tax deduction for expenses relating to repairs, maintenance or replacement of machinery, tools or premises you use to produce business income, as long as.

SelfEmployed Home Improvement Deductions, As a general rule, you can claim a capital works deduction for the cost of construction for 40 years from the date the construction was completed.

![7 Home Improvement Tax Deductions [INFOGRAPHIC] Tax deductions](https://i.pinimg.com/originals/bb/c7/4e/bbc74ee927d067f43bbaf4252e12eb28.jpg)